The list of duties of the debtor in connection with a bankruptcy case expanded with the 2005 bankruptcy “reform”.

The list of duties of the debtor in connection with a bankruptcy case expanded with the 2005 bankruptcy “reform”.

The list is found in 11 U.S. C. 521.

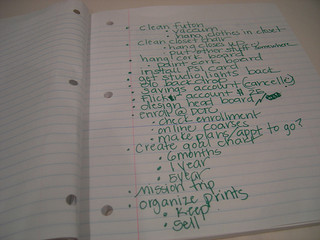

Edited and simplified, those duties include:

- File schedules, statement of financial affairs, certificate of §342(b) notices

- Provide payment advices (pay stubs) received in 60 days before filing

- File statement of monthly net income itemized to show how income is calculated &disclosures of anticipated changes in income and expenses

- File statement of intentions with respect to property subject to secured claim

- Perform such intentions

- Appear at the 341 meeting

- Not retain property without reaffirmation or redemption

- Get certificate of credit counseling

- Disclose interest in education individual retirement account or state tuition program

- Provide trustee with copy or transcript of last filed federal tax return [failure = dismissal]

- Upon request file copy of tax return annually while case pending

- In 13, file an annual statement of income and expenses for the previous tax year. and a monthly income of the debtor, within 45 days of anniversary of plan confirmation [521 (f)(4)]

- Show identification documents on request

- File post petition tax returns or get an extension

Designed to be daunting by a Congress hostile to individual debtors , the list largely consists of documenting the information in the schedules.

While tedious, it should not bar the attentive debtor from getting a discharge. An experienced bankruptcy lawyer will prompt you to get everything done so your case goes smoothly and you get your discharge.

Read more

What changed in bankruptcy with “reform”

Is it smart to file bankruptcy without a lawyer

Image courtesy of Flickr and chapendra.